How Palmoil.io helps you get EU Deforestation Regulation-ready

The EU Deforestation Regulation could be a turning point in efforts to reduce palm oil-related deforestation. With the regulation likely to go into effect next year, companies need to consider three factors. First, public support has polled as high as 87%, so industry will be under scrutiny to comply with the law. Second, there is no “green lane” for certification standards such as RSPO or ISPO. This means that while certified volumes may complement compliance requirements, they are not a substitute. And third, distinct from voluntary standards, the regulation would be enforced with fines, penalties, and seizures.

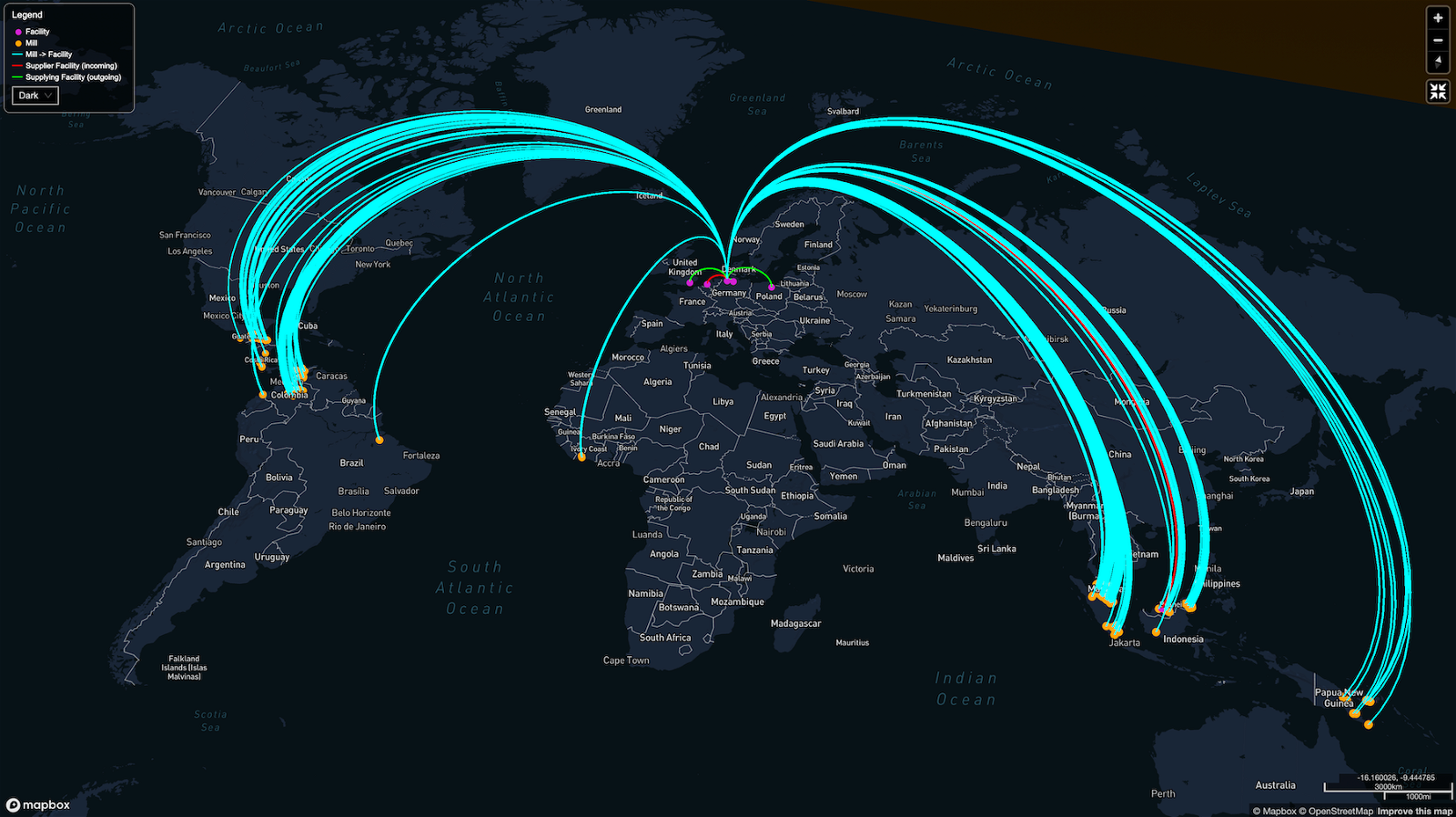

To comply, companies will need to provide geo-locations to all of the areas that they sourced to authorities. Traceability is perhaps the most challenging aspect of compliance. To help companies begin assessing their risk, this post explains a few practical ways that Palmoil.io can help companies find, review, and address potential regulatory issues.

Track grievance resolutions

Palmoil.io insight - Two thirds of all grievances filed remain unresolved

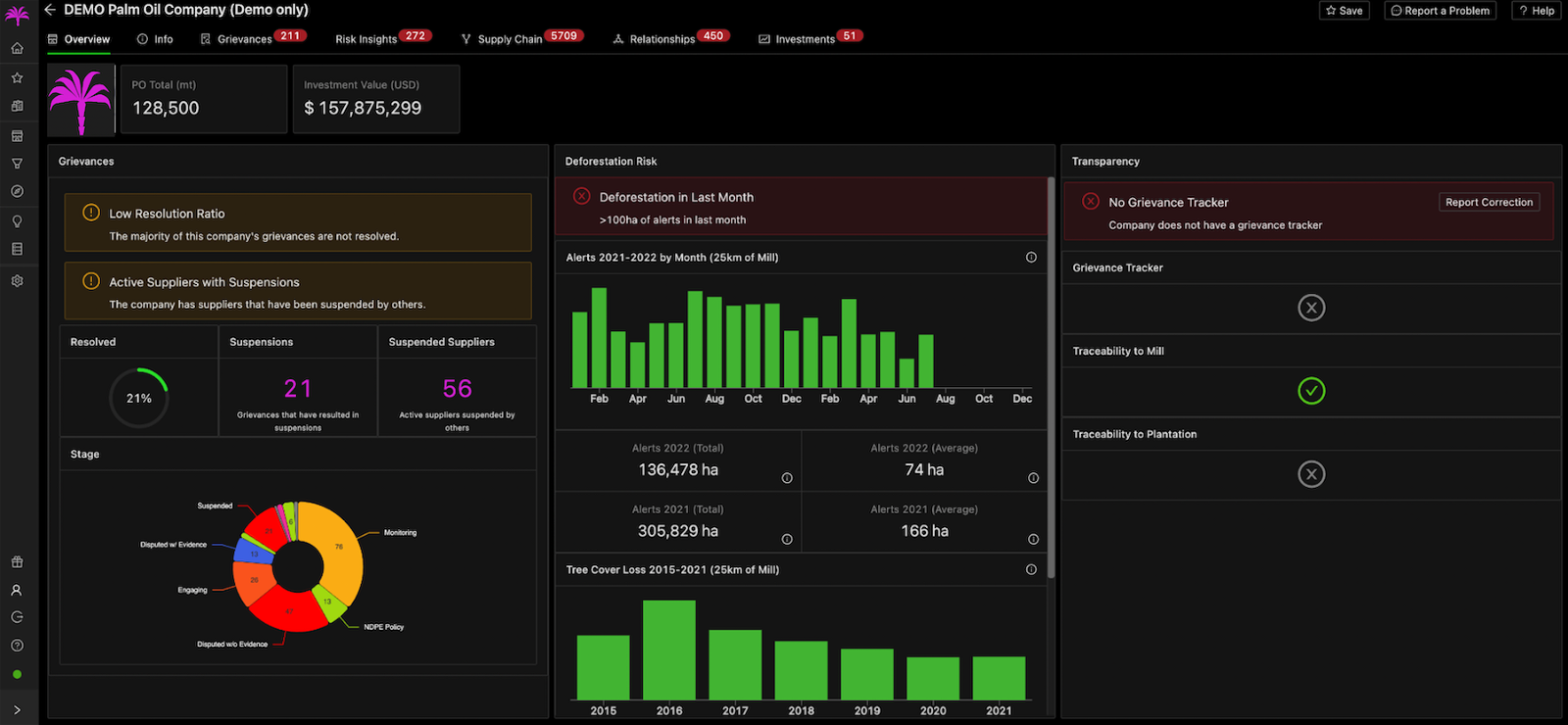

Tracking unresolved grievances is really the low hanging fruit of regulatory compliance. A grievance means that someone else has already filed a complaint and should be addressing it. Currently, most downstream companies leave the grievance monitoring to the trader who made the initial purchase. This company contacts their supplier, receives feedback, and reports it on their tracker.

This approach, however, poses risks. Frequently, reporting companies do not provide evidence of grievance resolution such as a map indicating whether deforestation was outside a concession or a labor dispute was resolved to the satisfaction of workers. Grievances are therefore often closed without evidence that the submitter is satisfied with the outcome. Furthermore, they often fail to file submitted grievances.

If you have a mill list, Palmoil.io tracks your grievances and files them to your dashboard, including cases that your supplier may not have filed. We provide alerts and charts, breaking down whether evidence has been provided, a resolution reached, and identify other companies exposed. With this information, you can track your unresolved grievances and encourage your suppliers to reach resolutions with the submitter.

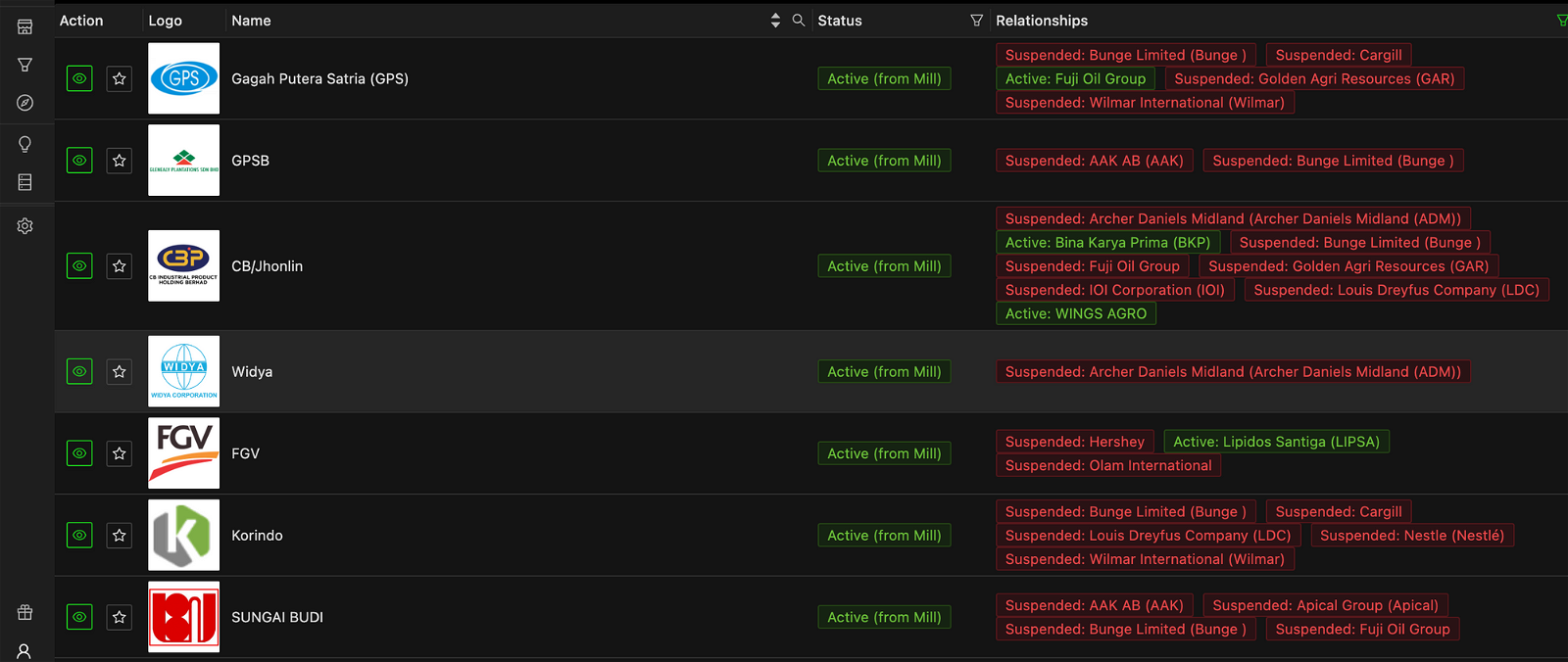

Identify suppliers that other companies have suspended

Suspensions are the tool of last resort for many traders. If a supplier’s deforestation violation is egregious or they refuse to enact a moratorium, traders will suspend them and block them from entering their supply chain. Suspensions, however, are rarely evenly applied. Some traders suspend the supplier, while others continue to source from them.

Palmoil.io insight: On average, the 20 largest refiners and traders source from over 25 suppliers with active suspensions

Given grievance cases have already undergone several rounds of peer review, a company with one active suspension against them should be monitored. Palmoil.io also tracks whether you are sourcing from suppliers that other companies have suspended.

Palm oil tracks suspensions based on grievance responses and relationships based on mill disclosures. The relationships tab on your dashboard will tell you which suppliers you have active relationships with as well as the relationship they have with other companies.

Build a list of potentially non-compliant concessions

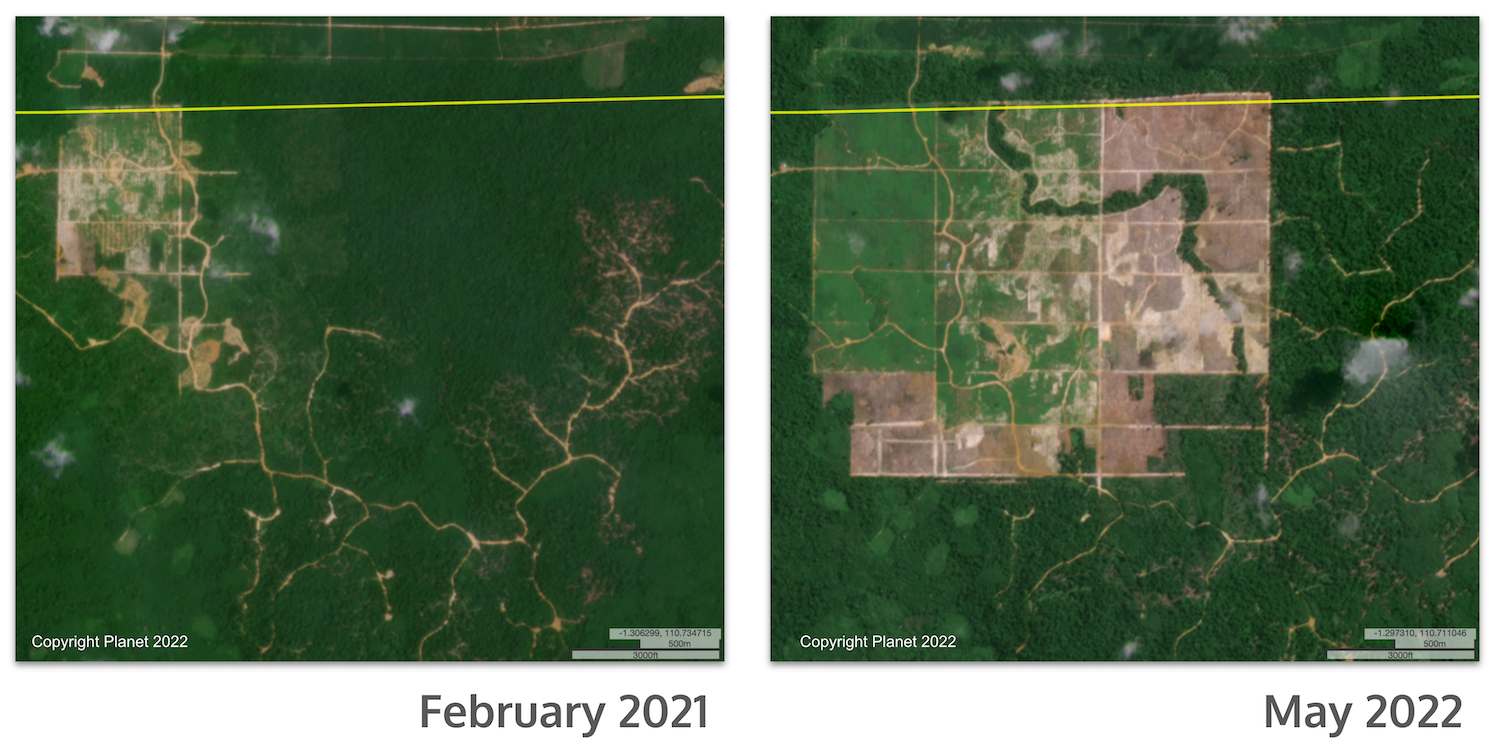

Traceability to “plot” is arguably the greatest challenge complying with the EU regulation. Under the proposed regulation, plots must not have cleared forest after December 2020. Any clearing after this cutoff date could be a violation.

Palmoil.io insight: We detected 338 concessions in Indonesia with over 100 hectares of deforestation in 2021

To help assess your risk, Palmoil.io links thousands of concessions in Indonesia and Colombia to mills. Concessions maps for more countries are under development. We use our insights on company ownership and geographic proximity to link concessions to mills in your supply chain.

You can then sort this list of concessions by those that had deforestation after December 2020. You can save a list of these concessions and share with your direct supplier for further insights.

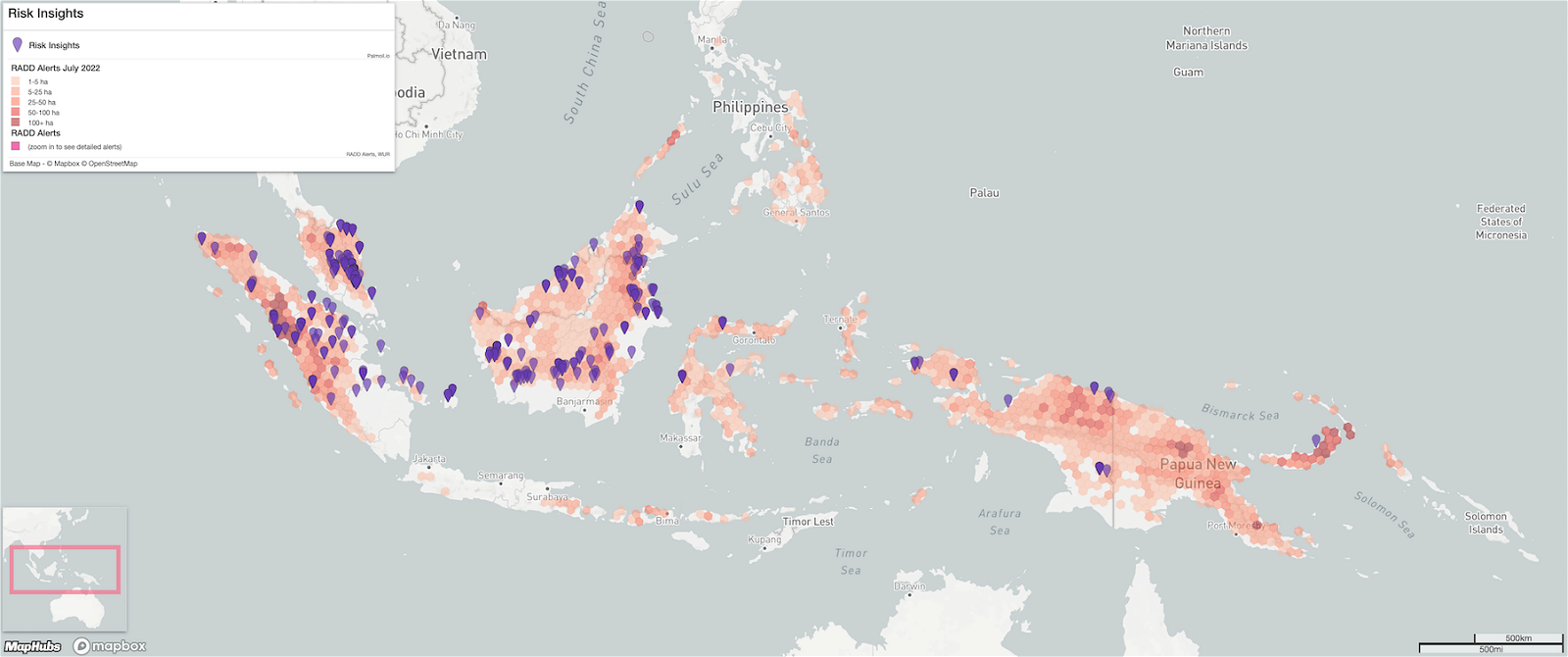

Use risk insights to actively monitor high risk mills and concessions

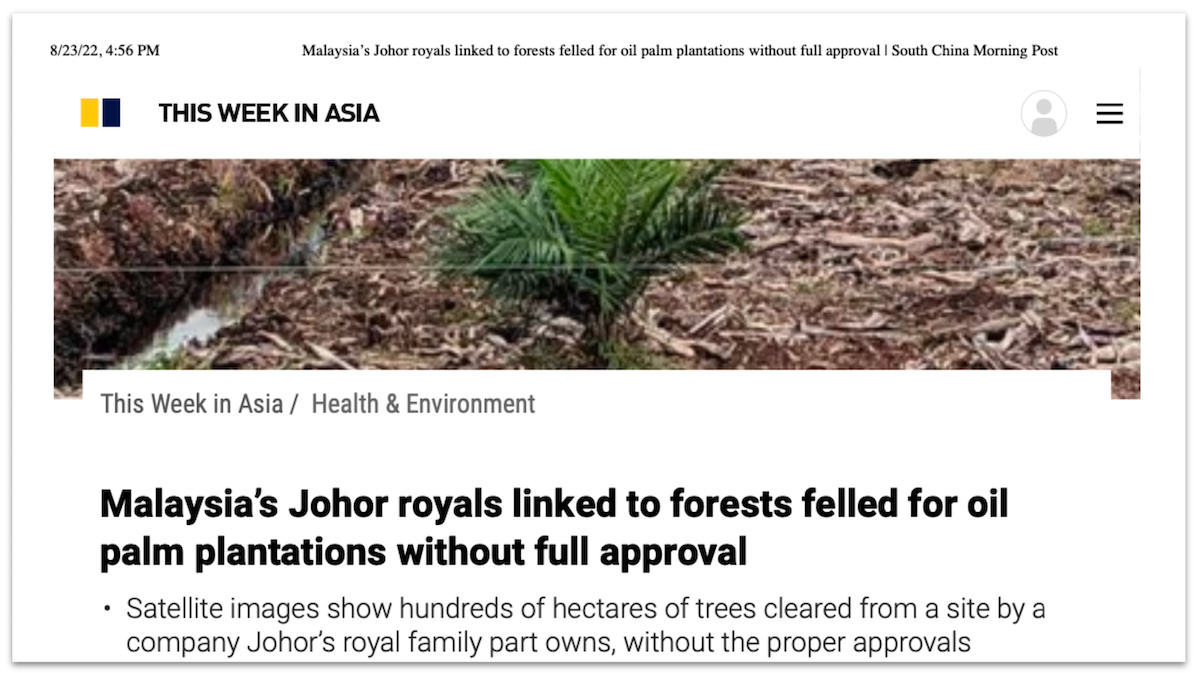

Despite reductions in palm-related deforestation, clearing for palm continues both within concessions and by smallholders. Industrial deforestation is acute within frontier areas such as Central and East Kalimantan, and Papua where concession ownership and legality is often opaque or disputed. Smallholder deforestation remains widespread and largely unmonitored.

Palmoil.io insight: We have produced over 330 Risk Insight reports

Every month, Palmoil.io publishes new Risk Insights reports, featuring both satellite imagery analysis, contextual maps, supply chain links, and transportation routes between deforestation cases and neighboring mills. The reports give you detailed information on both cases of industrial and smallholder-related deforestation and include spatial data files that can be shared with your suppliers for verification.

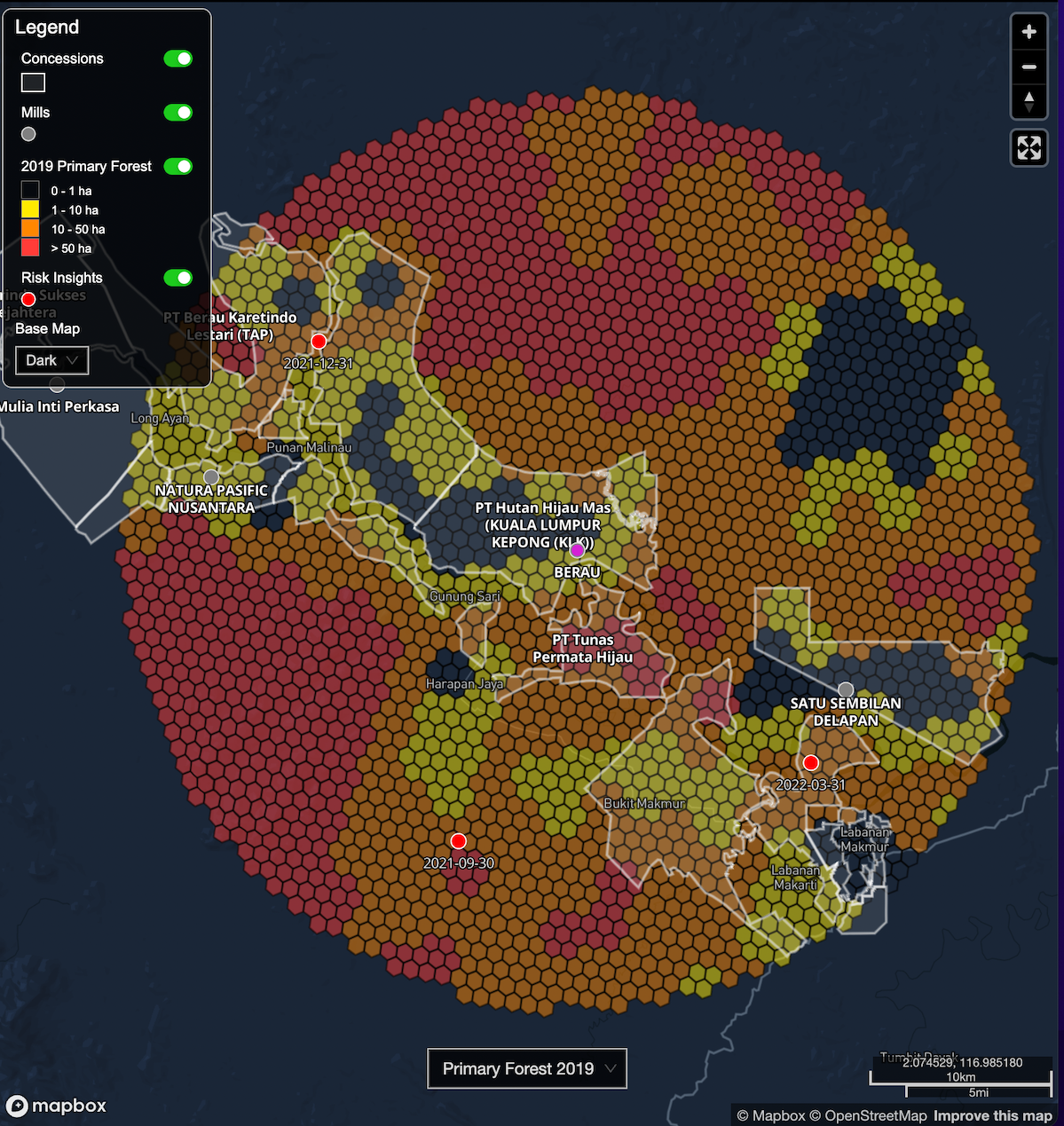

Monitor future risks by tracking remaining forest inside concessions and proximity to mills

“Hungry mills” is a new mill that drives land and forest conversion to plantations in the surrounding area. According to research, mills aim to operate at as close to their maximum capacity as possible, so investors rapidly recoup their investment. Palmoil.io has documented dozens of new mills driving new deforestation in Kalimantan, Papua, and the Peruvian Amazon. New mills are therefore likely to be higher risk than older more established facilities.

Palmoil.io insight: Almost 300 mills have over 50,000 hectares of primary forest within a 25km proximity

To assess current and future hungry mills, you can sort your mill list by remaining primary forest. For mills with high remaining forest, you can check whether nearby concessions are actively clearing forest and review risk insight reports for details. Mills with active palm-related deforestation and remaining forest are likely high future risk.

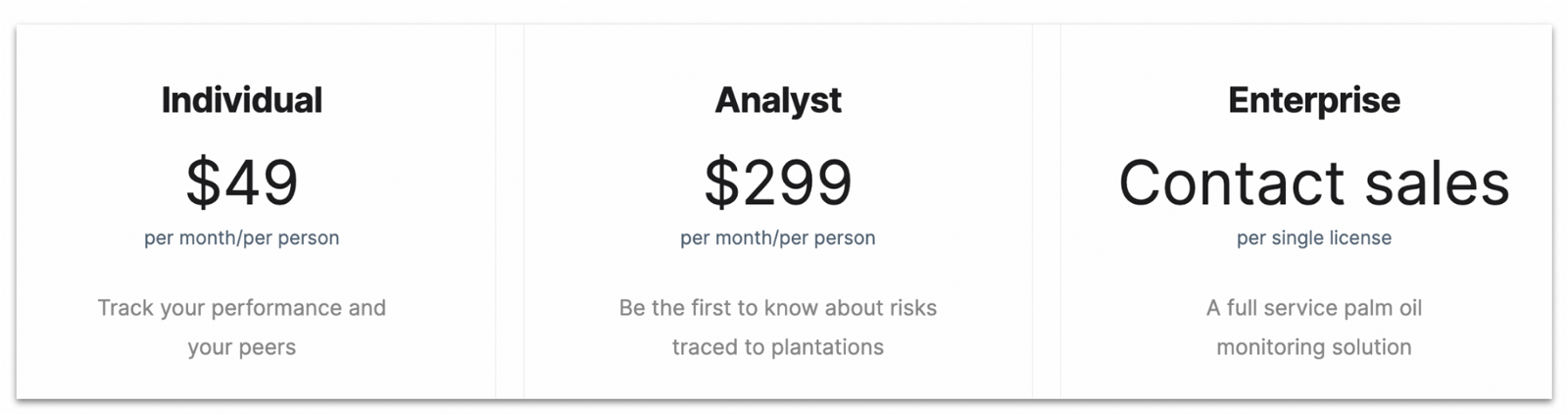

Get started with Palmoil.io today

In June, The Council of the EU, a key decision making body, adopted a position to “limit the consumption of products contributing to deforestation and degradation”. This paves the way for the proposed regulation to likely go into effect in 2024, and be potentially bolstered by similar laws planned in the UK and USA. Furthermore, the extreme droughts and forest fires afflicting Europe and the US this summer will likely further strengthen government and public resolve to address deforestation as part of climate mitigation measures.

The proposed regulation would undoubtedly be challenging to implement, but given its recent progress, palm oil is well positioned to lead other commodities towards fully compliant deforestation-free supply chains. And palmoil.io can help. We offer monitoring subscriptions a various prices, depending on your needs. Sign up at Palmoil.io/pricing or contact us today for quote.

Update (Aug 24 12:45pm): An earlier version of this post stated that the law would go into effect in 2023. It has been edited to reflect that the Council's request that "Articles 3 to 12, 14 to 22, 24, 29 and 30 shall apply no later than 18 months from the entry into force of this Regulation." This makes 2024 the more likely data of the proposed regulation going into effect.